Automate for outcomes with the most comprehensive business process automation platform. Leverage the power of workflow automation unified with content services, business rules, omnichannel communication, case management, RPA, and AI to deliver efficient, intelligent, and context-aware processes. Go beyond automation to build a continuously improving agile organization at a scale of thousands of processes. With business process management system, modernize work to unleash automated and touchless self-service that makes not only the customer happy, but also employees and partners.

How Does Newgen Solve for Your Business Process Management Needs?

Rapid Application Development

Leverage GenAI to rapidly design, develop, and implement powerful enterprise-grade applications for web and mobile with easy point-and-click configurability while leveraging a robust AI-powered low code platform. Create customizable domain-rich solutions to cater to dynamically evolving business requirements.

Business Process Automation

Automate complex, content-centric, enterprise-wide business processes while centrally managing agile AI-led business rules and streamlining processes through integrated robotic process automation. Furthermore, respond to unanticipated scenarios by leveraging the business process automation software’s and AI dynamic case management capabilities.

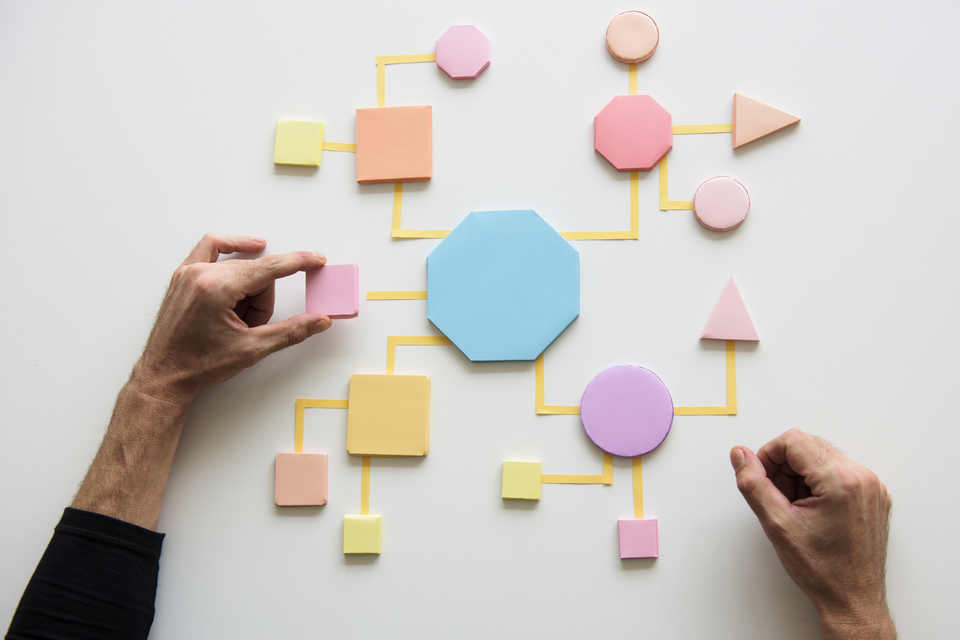

Contextual Engagement & Process Mapping

Newgen’s Business Process Management System can capture, manage, and consume content generated using the power of AI in the context of business processes. Derive context from information residing across various sources and deliver personalized communications by leveraging GenAI to customers across multiple touchpoints.

Continuous Improvement

Newgen’s Business Process Management System can help continuously optimize business processes to enhance customer experience, improve employee productivity, and reduce operational costs with process analytics, intelligent recommendations, real-time reporting, flowcharts, and monitoring

Lead with an Industry-recognized Platform

Organizations looking for an advanced content platform capable of scaling for heavy workloads and that need deployment flexibility and advanced automation and AI capabilities should consider Newgen.

The Forrester Wave™: Content Platforms, Q1 2025

Customers