Eliminate manual intervention and ensure zero underwriting errors with the auto underwriting rule engine. Meet regulatory requirements and adapt to dynamic business needs with our configurable solution. Automate end-to-end policy issuance process, deliver superior user experience, and ensure a shorter prospect to customer lifecycle.

Features of Newgen Policy Issuance and Underwriting Software

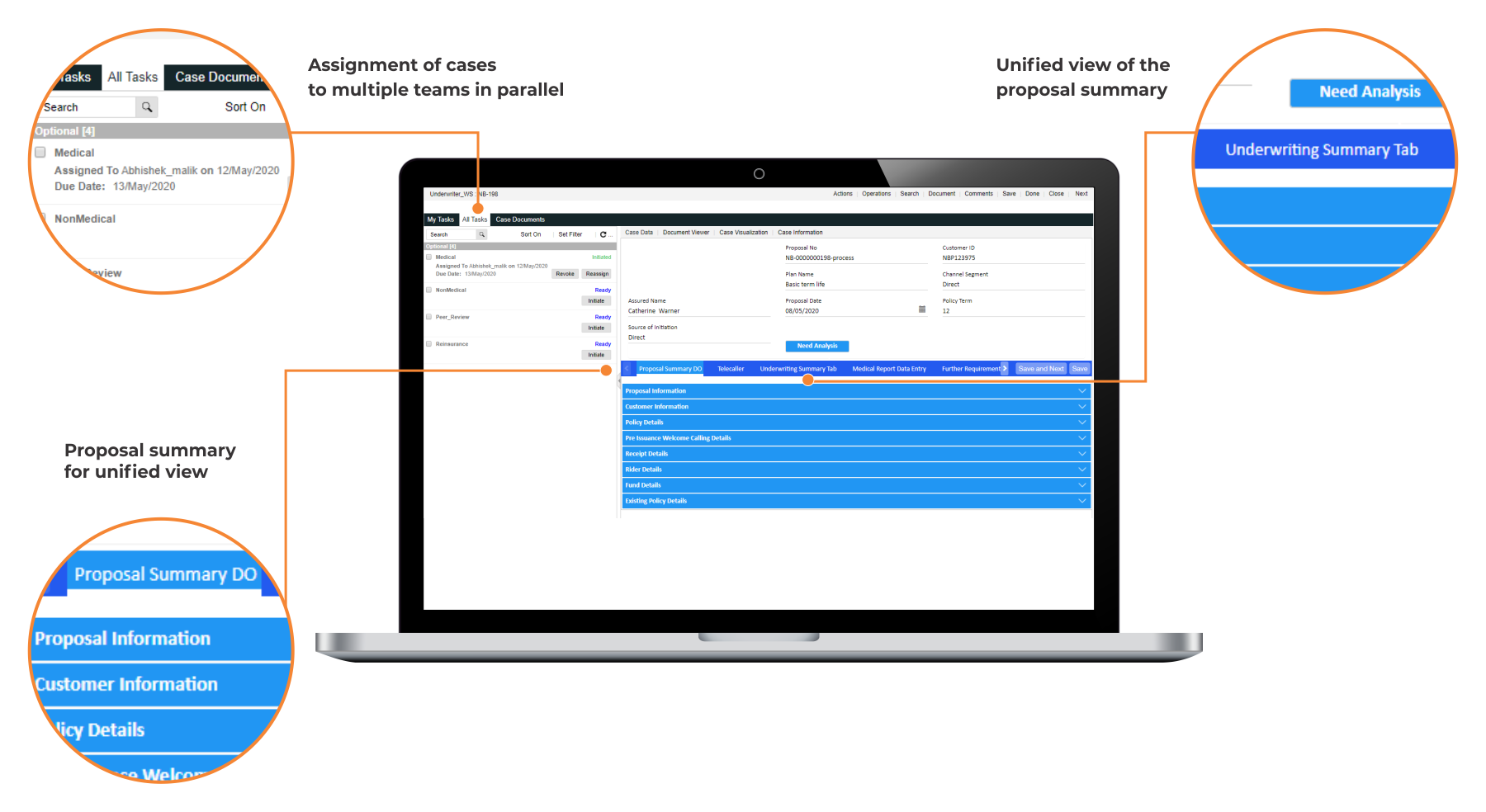

Policy Elements and Underwriting Analysis

Configurable user interface to define data elements per specific requirements

Sophisticated dashboards for in-depth data analysis and report generation

Core Underwriting Engine

Dynamic rules to facilitate straight-through processing of low complexity submissions and automate key underwriting tasks

Abstract underwriting rules and complex logic are configured into the system

Flexibility to change rules according to dynamic business requirements

Underwriting Evaluation

Automatic policy evaluation to maximize the percentage of straight-through pass cases for quick policy issuance

Auto-classification of non-straight-through cases and routing of cases to underwriters based on the authority limit

Additional Information Capture

Access to comprehensive case details to ensure informed decision-making

Request capabilities for additional documents and information, based on medical or non-medical parameters

Integration and Personalization Capabilities

Seamless integration with third-party and legacy applications, such as policy administration, CRM, etc.

Omnichannel, personalized engagement across all channels, including mobile, web, in-person, chatbox, social, and bots

Brands using Newgen Platform