Streamline student loan management processes by managing the entire loan lifecycle, right from lead processing, assessment, and servicing to collections management. Allow students to initiate the process anytime-anywhere via digital channels — mobile applications and a customer self-service web portal. Leverage the rule-based, in-built risk assessment engine powered by artificial intelligence (AI), to streamline the process. Furthermore, streamline various disbursal and post-disbursal activities, including loan settlement, rescheduling, and closure services using the general ledger.

Features of Newgen Student Loan Management Software

Student Onboarding

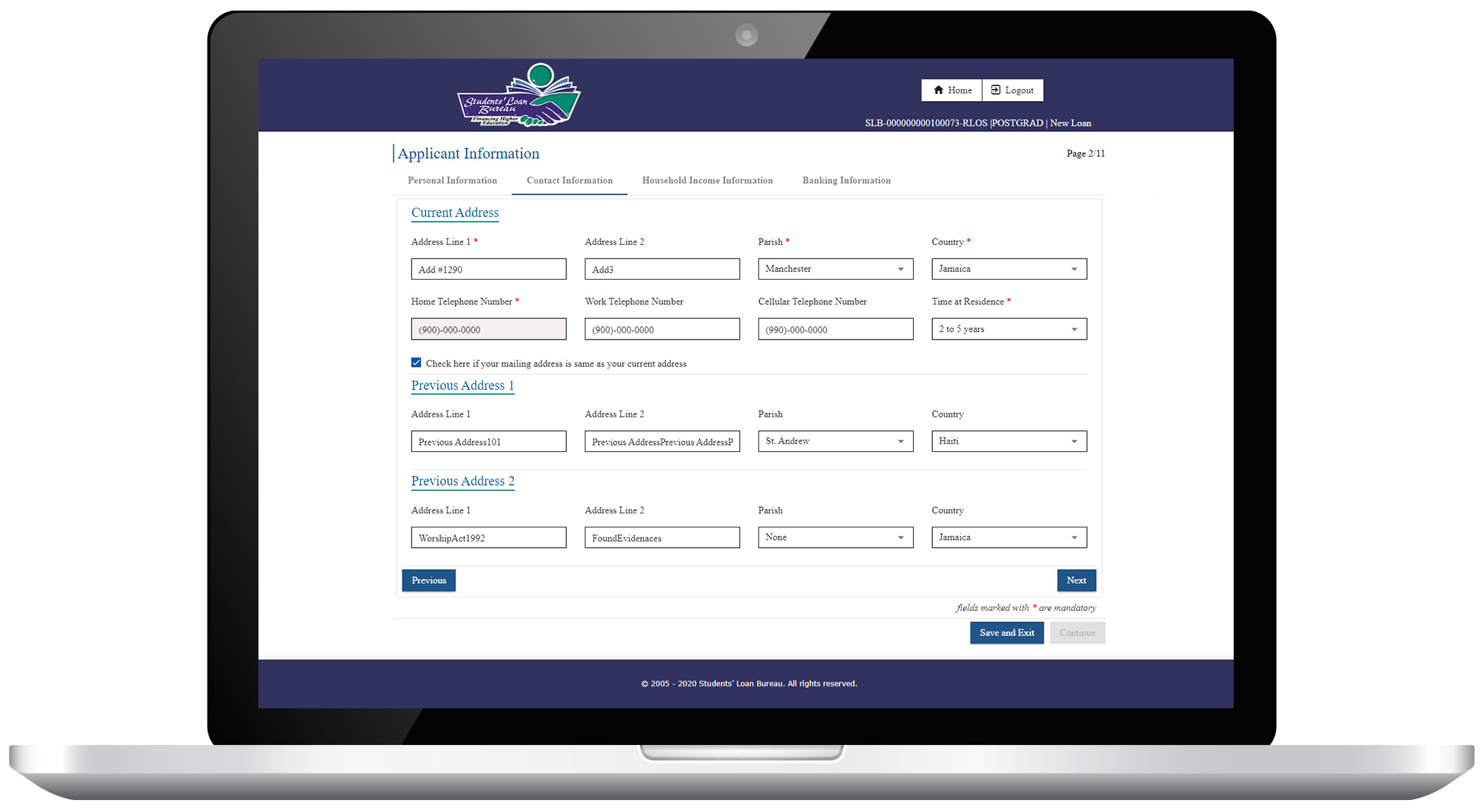

Omnichannel student onboarding via customer self-service portal and mobile application

Loan disbursal within minutes

Seamless scanning and capturing of students’ profiles and auto-classification of the information from the documents like identity proofs, degrees, certificates, etc.

Geotagging the student’s location on mobile and enabling smooth KYC, including video KYC with data masking

Validating credentials and calculating the exposure of pre-approved educational institutions

Loan Underwriting and Tracking

Data engine-based credit analysis and predictions

Seamless integration with the credit bureau and core banking systems to perform background checks, feeding the student’s data, and fetching generated loan details

Faster, AI-enabled underwriting with straight-through processing for pre-approved student loan applications

Payment Services and Closure

Out-of-the-box services for payments, re-pricing, deferral, part payment, due date change, etc.

Schedule-based loan disbursal to the educational institution’s account using single, multiple, and split payment options

Multiple payment functionalities, such as disbursals, refunds, customer receipt collection, manual advice creation, waive off, knock off, and post-date cheque maintenance

Flexible loan closure options

Account Maintenance and Reporting

Automated accounting and financial reporting

Comprehensive reporting module for generating accounting and transactional reports

Detailed reports for demonstrating key educational milestones and achievements throughout students’ learning journey

Collections Management

Personalized interactions with a real-time interface, multi-channel notifications, and a 360-degree view of previous interactions with a student-borrower

Automated case bucketing and routing for tracking NPAs and enhanced visibility through collection monitoring reports

Seamless collection entry by capturing payment mode and amount from CMS, mobile application compatibility, and processing waivers

Streamlined loan restructuring with collection strategy definition

Automated incentive pay-out computation

Success Stories

Trusted Globally for Over 30 Years Customer