Our mortgage lending software is designed to cater to the needs of lenders, including banks & non-banks, credit unions, building societies (community focused), and home guarantee scheme (HGS) providers. Orchestrate end-to-end mortgage lending—from origination, document digitization, lead capture, approval, and funding to servicing—in a paperless, workflow-driven environment. Enable touchless processing of eligible loan applications, automatically create new customer ID and loan accounts, and trigger disbursements while complying with LIXI transaction standards, APRA regulatory requirements, and responsible lending guidelines, ISO 27001. Seamlessly integrate with legacy and third-party systems, including core banking solutions, CreditorWatch, Illion, Equifax, Experian, GreenID, OCR Labs, credit assessment websites, such as bankstatements.com, and CoreLogic to automatically fetch and validate information, resulting in a shorter turnaround time and a better customer experience.

Features of Newgen’s Mortgage Lending Software

Omnichannel Origination and Self-service Portal

Get multi-channel origination support for customer self-service, in-branch, and customer care channels (anytime-anywhere, across any device). Access easy-to-use electronic/online-based dynamic forms. Ensure transparency with necessary disclosures to customers. Avoid duplicate data entry with a single, unified interface for all users. Also, get specialized broker/franchise portals.

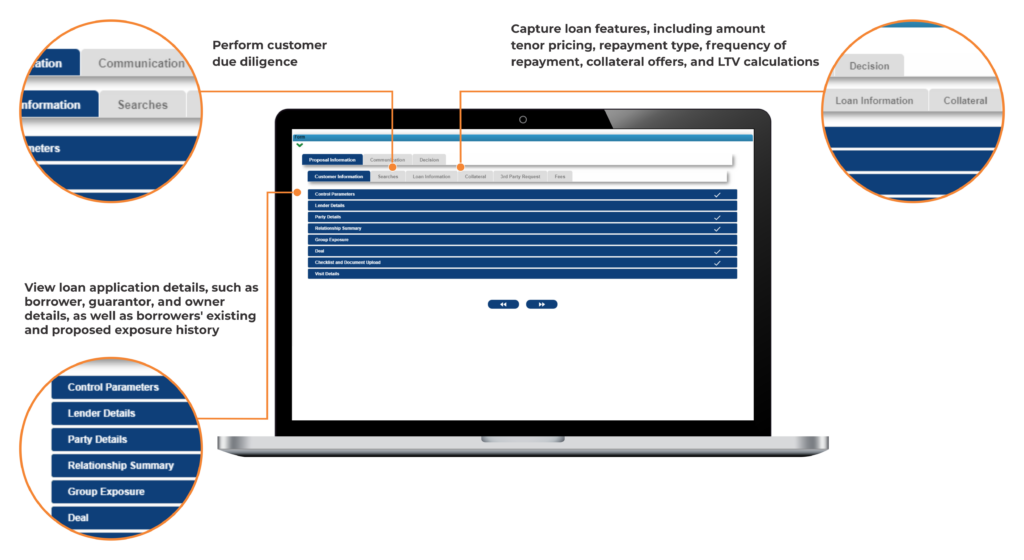

Pre-screening and Credit Analysis

Integrate with external credit bureaus for AIML/blacklist checks. Get a comprehensive credit assessment based on the applicant’s financials and credit scores and rules-driven application scoring on predetermined criteria. Predict the probability of defaults and dropouts with AI/ML-powered calculator. Send out AI/ML-powered pre-approved offers to qualified applicants. Determine the feasibility of mortgage offer through serviceability calculators.

Automated Approvals and Optimized Workflow for Funding and Closing

Simplify straight-through loan processing with an in-built credit decision-making engine. Get support for mobile-based approvals and notifications, rule-based approvals (sequential or parallel), and appropriate decision-based workflow routing and delegation. Enable monthly payment schedule generation (balloon, bullet payment, and more) and stage-wise disbursement support for construction loans.

Robust Activity Monitoring

Track product and process performance through real-time and user-specific dashboards with end-to-end visibility. Get robust exception management with detailed tracking & alerts. Generate multiple reports with an in-built reporting module. Prevent delinquencies by enabling a rule-based early warning system and payment monitoring.

Servicing and Comprehensive Lead Management

Ensure comprehensive mortgage servicing, including query/complaint management, modifications, and foreclosure processes. Track and maintain a chronological record of all activities, changes, and updates with audit history of cases. Enable upsell and cross-sell opportunities.

Risk Management and Compliance

Integrate an in-built risk management engine for complete due diligence, including background checks, verifications, and risk-based pricing. Get LIXI-compliance adherence for lending and mortgage processing in Australia and Australian Prudential Regulation Authority (APRA) regulatory requirements. Ensure compliance with responsible lending guidelines with comprehensive checklists and validations.

Extensive Document Management

Generate loan packages as per pre-defined bank-specific templates. Maintain and segregate documents based on deferred, waived, received, and pending. Support e-Signatures/wet signatures and get pre- and post-disbursement checklists. Enable dynamic masking of GDPR data from personal documents, such as passports and driving licenses. Secure document storage from unauthorized access, modification, deletion, or disclosure as per APRA regulations. Store, retain, and dispose of long-term documents, including tax returns, bank statements, contract of sale, valuation report, and inspection report.

Success Stories

Trusted Globally for Over 30 Years Customer