Newgen, a trusted partner since 2019, has empowered us to drive our digital transformation with speed and precision. Their advanced platform and domain expertise support our goals.

– Khizar Momin, Chief Technology Officer, Toyota Financial Services India

Industries We Serve

Housing Finance Companies (HFCs)

Deliver a fully digital, home loan experience with Newgen’s low-code AI-first loan origination solution. Automate end-to-end processes, from application to disbursal, enhancing borrower convenience, reducing turnaround time, and boosting sanction rates without a single branch visit.

Retail Lending

Enable faster go-to-market, agile credit decisioning, and personalized customer journeys. With Newgen, scale unsecured loans, accelerate disbursals, reduce risk, and stay compliant with AI-driven workflows, all on a secure, scalable foundation.

Vehicle & Equipment Finance

Automate complex workflows, from application to disbursement, with risk profiling and document management, by leveraging an AI-native low-code platform. Offer quick, reliable financing for vehicle and equipment purchases.

Supply Chain & Captive Finance

Enable end-to-end financing lifecycle management, from loan initiation to disbursement, servicing, collections, and recovery, with Newgen’s AI-first Low-code platform, purpose-built for NBFCs. Support direct customer lending, dealer financing, and supply chain finance with agility and control.

Microfinance Institutions (MFIs)

Streamline group lending, loan origination, disbursement, and collections. Ensure faster decisions, improved compliance, and last-mile connectivity, enabling financial inclusion through scalable, mobile-first, and AI-native microfinance operations.

Asset Reconstructions Companies (ARCs)

Accelerate recoveries and maximize NPA portfolio returns with Newgen’s AI-first solutions for ARCs. From smarter acquisitions to faster collections, empower your teams with real-time insights, seamless due diligence, and intelligent automation across the asset reconstruction lifecycle.

MSME Lending

Digitize and automate the entire lending lifecycle with Newgen’s AI-first low-code platform, accelerating loan origination, simplifying servicing, and driving smarter collections. Empower faster decisions, seamless customer journeys, and scalable growth.

Success Stories

Key Benefits

- Configurable, rule-based framework

- Intelligent underwriting module, comprehensive loan document checklist, and automated alerts

- Real-time dashboards to monitor critical business events and operational productivity

- Cloud deployment for ease of use and cost optimization

- AI/ ML-based analytical models for customer acquisition and retention

Trusted by Leaders

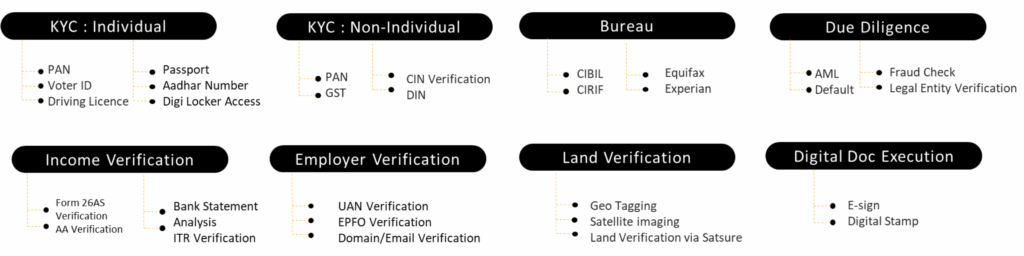

Newgen Integration Ecosystem

Find Your Winning Strategy with Newgen

Schedule a Demo to see Newgen’s NBFC Journey Automation Solutions in action.

Schedule Demo